What are Target Date Funds

Target Date Funds are designed to simplify investing. You choose a fund based on your retirement date, which is typically around age 65:

Why USask introduced Target Date Funds

The University wants to make it easy for you to invest your hard-earned pension savings—and Target Date Funds simplify investing for anyone with long-term savings objectives, such as retirement.

Target Date Funds (new)

Take into account your proximity to retirement and automatically adjust your portfolio to take on less risk the closer you get to age 65 (a typical retirement date).

Life Cycle Funds (old)

Do not invest based on your age and retirement date and instead match your investments with your risk profile (i.e. how much investment risk you are willing to take).

Not sure which funds you are currently invested in? Log in to your Sun Life account and select my financial centre > Accounts > Balances.

How Target Date Funds work

Target Date Funds are made up of a mix of funds, including bonds and equities. This mix is automatically rebalanced and de-risked over time, based on your age and retirement date. The further you are from retirement, the greater the risk and investment mix of equities; the closer you are to retirement, the lower the risk and greater the investment in bonds.

Glidepaths

The following graph demonstrates how a member's target date investment allocations would be automatically adjusted throughout their career.

Investment mix

The University of Saskatchewan is adjusting the investment mix of the target date funds for the Academic Money Purchase and Research pension plans, resulting in lower investment fees.

The changes better reflect current global market weights and the plan’s investment objectives. The updated target date fund mix, which includes a new emerging market allocation, is expected to improve returns and reduce risk for passively investing members.

The table below summarizes Usask's current default Target Date Fund—the fund closest to the year you turn age 65.

U.S. Equity Fund = USEF

International Equity Fund = IEF

Canadian Equity Fund = CEF

Emerging Market Equities = EME

Bond Index Fund = BIF

| USask Target Date Fund |

Target retirement date |

Investment Mix % |

Current Fees |

Previous Investment Mix % |

Previous Fees |

Change % |

|---|---|---|---|---|---|---|

| 2015 | 2013-2017 | USEF = 26.9 IEF = 11.3 CEF = 4.5 EME = 2.3 BIF = 55.0 |

0.15% | USEF = 16.9 IEF = 16.9 CEF = 11.2 BIF = 55.0 |

0.22% | -33.8% |

| 2020 | 2018-2022 | USEF = 31.5 IEF = 13.1 CEF = 5.3 EME = 2.6 BIF = 47.5 |

0.16% | USEF = 19.7 IEF = 19.7 CEF = 13.1 BIF = 47.5 |

0.24% | -34.19% |

| 2025 | 2023-2027 | USEF = 36.0 IEF = 15.0 CEF = 6.0 EME = 3.0 BIF = 40.0 |

0.17% | USEF = 22.5 IEF = 22.5 CEF = 15.0 BIF = 40.0 |

0.26% | -34.29% |

| 2030 | 2028-2032 | USEF = 44.4 IEF = 18.5 CEF = 7.4 EME = 3.7 BIF = 26.0 |

0.19% | USEF = 27.8 IEF = 27.7 CEF = 18.5 BIF = 26.0 |

0.30% | -35.11% |

| 2035 | 2033-2037 | USEF = 50.9 IEF = 21.3 CEF = 8.5 EME = 4.3 BIF = 15.0 |

0.21% | USEF = 31.9 IEF = 31.9 CEF = 21.2 BIF = 15.0 |

0.33% | -35.15% |

| 2040 | 2038-2042 | USEF = 55.7 IEF = 23.3 CEF = 9.3 EME = 4.7 BIF = 7.0 |

0.23% | USEF = 34.9 IEF = 34.9 CEF = 23.2 BIF = 7.0 |

0.35% | -34.99% |

| 2045 | 2043-2047 | USEF = 58.8 IEF = 24.5 CEF = 9.8 EME = 4.9 BIF = 2.0 |

0.24% | USEF = 36.7 IEF = 36.8 CEF = 24.5 BIF = 2.0 |

0.37% | -36.27% |

| 2050 | 2048-2052 | USEF = 58.8 IEF = 24.5 CEF = 9.8 EME = 4.9 BIF = 2.0 |

0.24% | USEF = 36.7 IEF = 36.8 CEF = 24.5 BIF = 2.0 |

0.37% | -36.27% |

| 2055 | 2053-2057 | USEF = 58.8 IEF = 24.5 CEF = 9.8 EME = 4.9 BIF = 2.0 |

0.24% | USEF = 36.7 IEF = 36.8 CEF = 24.5 BIF = 2.0 |

0.37% | -36.27% |

| 2060 | 2058-2062 | USEF = 58.8 IEF = 24.5 CEF = 9.8 EME = 4.9 BIF = 2.0 |

0.24% | USEF = 36.7 IEF = 36.8 CEF = 24.5 BIF = 2.0 |

0.37% | -36.27% |

| 2065 | 2063-2067 | USEF = 58.8 IEF = 24.5 CEF = 9.8 EME = 4.9 BIF = 2.0 |

0.24% | USEF = 36.7 IEF = 36.8 CEF = 24.5 BIF = 2.0 |

0.37% | -36.27% |

Risk level tolerence

Generally, the further you are from retirement, the greater risk you can take on—this is called “risk tolerance.” The rationale behind this concept is that the younger you are, the more time you’ll have (i.e. “time horizon”) to recover from any potential investment losses, but also benefit from higher investment gains.

The closer you get to retirement, the lower your risk tolerance. That means, the sooner you’ll need the money, the less able you are to take risk and potentially experience investment losses.

Risk level of investments

HIGHER RISK

In a target date fund the members take higher investment risk when they are further away from retirement to maximize their investment earnings (i.e. the member's investment mix is more aggressive with a greater amount of equities)

LOWER RISK

As the members near retirement and eventually need to draw on funds, they take lower investment risk (i.e. the member's investment mix becomes more conservative)

Personalized support

We encourage you to speak with a financial planner to ensure your investment strategy meets your savings goals. If you don’t have a financial planner, you can find one at fpcanada.ca/findaplanner.

You can also call 1-866-733-8612 to speak to Sun Life’s customer care centre—they can help you:

- Determine how comfortable you are with investment risk

- Review your investment options

- Consider which funds are most appropriate for you

- Complete your transactions over the phone (with your consent)

Choosing the right investment path

Your investment selections depend on your financial goals, your comfort with risk, and your life stage.

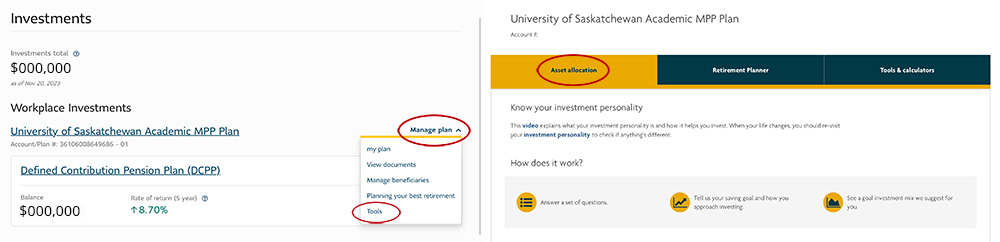

Use the Asset allocation tool on www.mysunlife.ca to help determine how much risk you’re willing to take when it comes to investing. This tool can also help you choose the right funds for you. Simply log in to www.mysunlife.ca and select:

Manage plan > Tools > Asset allocation

The chart below might also help you choose the investment path that meets your needs.

If you don’t want to spend a lot of time managing your funds or don’t have a lot of investment knowledge…

Consider the Help me do it path where investments are chosen for you.

Currently in help me do it path you are automatically invested in a Target Date Fund closest to the year you turn 65. The underlying investments will automatically adjust over time to more conservative options as you approach age 65. If you're eligible to retire early or wish to retire later than age 65, you can choose another Target Date Fund.

If you want to build your own mix of funds based on your financial goals, your comfort with risk, and your life stage...

Consider the Let me do it path where you choose your own investment mix with self-selected funds.

In the Let me do it path, you have access to your own mix of funds to:

- Invest based on your risk tolerance (complete the Asset allocation tool on www.mysunlife.ca)

- Regularly monitor and rebalance your portfolio to keep your desired level of risk

In addition to investing in a Target Date Fund, you can also choose to invest in the following:

Sun Life Investment Options

| Money market | Sun Life Financial Money Market Segregated Fund |

| Bond (fixed income) | BlackRock Universe Bond Index Segregated Fund |

| Canadian equities | University of Saskatchewan Canadian Equity Fund |

| U.S. equities | BlackRock U.S. Equity Index Segregated Fund |

| International equities | University of Saskatchewan International Equity Fund |

Aggresive

| Canadian Equity | 26.67% |

| U.S. Equity | 26.67% |

| International Equity | 26.67% |

| Bonds | 20.00% |

Balanced

| Canadian Equity | 20.00% |

| U.S. Equity | 20.00% |

| International Equity | 20.00% |

| Bonds | 40.00% |

Conservative

| Canadian Equity | 6.67% |

| U.S. Equity | 6.67% |

| International Equity | 6.67% |

| Bonds | 80.00% |